New PAN card

What does the Permanent Account Number (PAN) mean??

PAN is a combination of 10 characters.

- The first 3 characters are alphabetic i.e any combination from the English alphabet.

- The fourth character denotes the category of the taxpayer. The categories are as follow

- A – Association of Persons

- B – Body of Individuals

- C – Company

- F – Firms

- G – Government

- H – Hindu Undivided Family

- L – Local Authority

- J – Artificial Judicial Person

- P – Individual

- T – Association of Persons for a Trust

- The fifth character denotes the first character of the cardholder’s surname.

- The next four characters are numbers between 0001 and 9999

- The last character is alphabet check letter.

Documents Required For New PAN Card

To apply for a PAN Card, below is the list of documents

If you are an Individual Applicant

- Proof of identity such as Aadhaar for instant application, for offline mode you can submit driving license , voter id etc

- Proof of address such as utility bill, water bill , credit card statement,Driving License , Domicile certificate, marriage certificate, matriculation certificate, etc.

If you belong to a Hindu Undivided Family (HUF)

- affidavit issued by the Karta of the HUF.

- If you belong to HUF and is individually applying for a PAN Card, submit the proof of identity, proof of address, and date of birth proof.

For Companies Registered in India

- copy of the Registration Certificate issued by the Registrar of Companies

Firms and Limited Liability Partnerships Registered or Formed in India

- copy of the Registration Certificate issued by the Registrar of Companies

- copy of the Partnership Deed

For Trusts Formed or Registered in India

- submit a copy of the Registration Certificate Number issued by a Charity Commissioner.

For Association of Persons

- Agreement Copy or Registration Number Certificate issued by the Registrar of Co-operative Society or Charity Commissioner, or any document issued by the Central or State Government

Applicants who are not Citizens of India

- Proof of identity such as a Copy of PIO issued by the Government of India, Copy of OCI issued by the Government of India, Passport Copy

- Proof of Address – bank statement of the residential country, NRE Bank statement, Copy of visa by an Indian company, registration certificate issued by FRO,

To apply for new pan card youy need you have to visit the official website below

here is the procedure of applying for new pan card online and get the soft copy wthin 30 minutes

How to Get a New PAN Card in 30 minutes Online?

- Step 1: Visit any of the given below official website.

- Step 2: Choose the type of form you want like individual/firm/huf etc

- Step 3: fill all the details properly and Submit the application.

- Step 4: you can track the status of your new pan card application.

- Step 5: Get your PAN card within 30 minutes on your registered e mail address

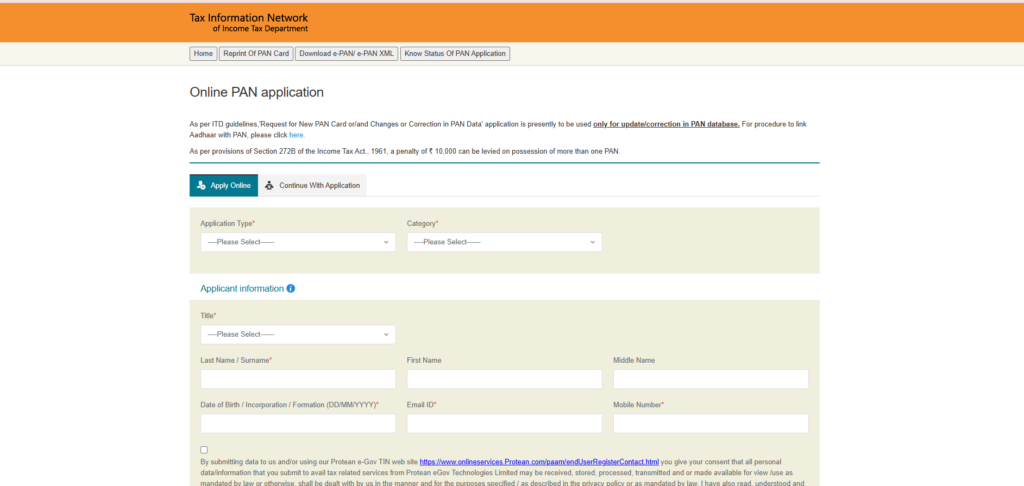

Apply for New PAN Card Via NSDL?

1 – Visit official nsdl website

2 – Select the application type.

3 – Choose your category.

4 – Enter name, date of birth, email ID, and mobile number.

5 – Agree terms and conditions.

6 – Enter the Captcha Code. click on ‘Submit’.

7 – you will get an acknowledgement number.

8 – Enter the details of acknowledgement and fill details

9 – You will need to upload the relevant documents and make the payment of rs 107 for pan card with ofline copy ot be received on registered address

New PAN card link 1

https://www.pan.utiitsl.com/newA.html

New PAN card link 2

https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html

New PAN card link 3

https://www.incometax.gov.in/iec/foportal

FAQs on PAN Card

- what is validity of pan card?

- PAN is valid for a lifetime.

- How should I fill the PAN application form?

- PAN Card should be filled out legibly in English. use capital letters and black in to update details.

- Where should the PAN Card application form be submitted?

- The PAN Card application form, once duly filled in and self-attested, can be submitted along with all relevant documents to any one of the PAN Centers

- When I submit Form 49A for PAN Card, what are the charges that I have to bear?

- address is within India, then the PAN Card processing fee is Rs.110, i.e., Rs.93 (application fee) + 18% GST.

- address is outside India, the PAN Card processing fee is Rs.1,020, i.e., Rs.93 (application fee) + Rs.771 (dispatch charges) + 18% GST.

- Is it mandatory to include the father’s name for a female who is married/widow/divorced?

- All female applicants should include only their father’s name.

- Can I apply for more than one PAN?

- No, you cannot hold more than one PAN.

- Will I get an acknowledgement when I submit my PAN form?

- Yes , unique 15-digit number.

- Should I mention my email ID or number on the form?

- It is mandated for all applicants to provide either their email ID or telephone number

- Can I get the information on my PAN card corrected?

- Yes, you can get the information corrected on your PAN card.

- can i hold hold more than one PAN card?

- No, penalty of Rs.10,000 under Section 272 B of the Income Tax Act, 1961 for more than one pan card.